Hybrid car finance

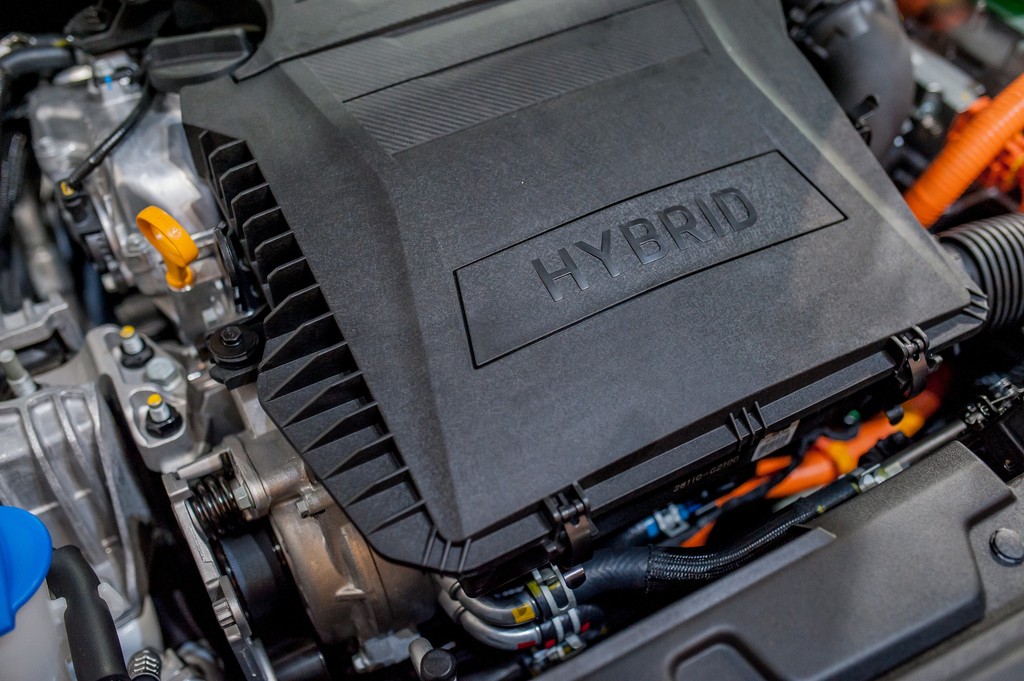

Hybrid cars offer environmentally conscious drivers a way to reduce their carbon footprint without sacrificing performance. With the cost of hybrid cars coming down and their popularity on the up, we take a closer look.

Representative 14.7% APR

With their many benefits, it’s no wonder that hybrid cars are becoming increasingly popular. Some of the benefits include:

Reduction in emissions

Better gas mileage than traditional gas-powered cars

Often exempt from ULEZ (Ultra Low Emission Zones) charges due to their lower emissions

An alternative to hybrid cars are fully electric cars – also known as EVs. Electric cars are growing in popularity every year and will eventually replace petrol and diesel cars entirely. There are a few different types of fully electric vehicles on the market at present, including:

Battery electric vehicles (BEVs)

Fuel cell electric vehicles (FCEVs)

Extended range electric vehicles (E-REV)

These are powered by electric batteries only; unsurprisingly they have a far bigger range than the battery capacity of hybrid vehicles and they must be plugged into an electric charging point to recharge. The difference between a fully electric vehicle and a plug-in hybrid is that electric cars don’t have a combustion engine at all.

The combination of a battery and an engine results in greater fuel economy and fewer CO2 emissions when compared with a conventional car, without compromising on overall performance. This is the great appeal of the modern hybrid. What might draw you to one over the other boils down to what’s important to you, your driving habits and where you live. For example:

If you live near charging stations or somewhere where you can install a charger, then a PHEV could be a good choice.

If you live in central London where fully electric cars and plug-in hybrids are exempt from the congestion charge this could sway you towards a plug-in.

If you don’t have easy access to electric vehicle charging points, then a full hybrid might suit you better as you won’t have to worry about charging it at all.

To buy outright, hybrids can be more expensive than petrol or diesel cars - but there are plenty of financial incentives to encourage you to switch to a hybrid, including exemption from congestion charges and lower running costs.

Because of their better fuel economy and lower tailpipe CO2 emissions, most CO2 based car tax has traditionally been lower for hybrids than for their petrol/diesel equivalents. However, recent changes to the law mean that hybrid cars now have to pay standard annual rate car tax. See the government’s car tax rate tables for full details.

Hybrid cars are becoming more accessible all the time as manufacturing costs decrease; these cost reductions are quickly passed on to consumers, making them more affordable every year. They are typically less expensive to buy than fully electric cars, which makes them the more affordable ‘greener’ option for many.

The additional power supplied by the electric motor also results in improved fuel efficiency: hybrids don’t rely solely on fossil fuels and therefore release fewer gas emissions, meaning they are more economical and less damaging to the environment than conventional cars.

Whether you're looking at a new or used hybrid, financing is a simple and safe way to spread the cost - just like with traditional petrol or diesel vehicles. While hybrids often have a higher upfront price, especially new models, they typically offer lower running costs. Over time, fuel savings and potential tax benefits can help offset that initial spend.

Ready to buy but unsure of your budget? Try our free car finance calculator to find out how much you could be eligible to borrow and to see an illustrative example of what your repayments could look like.

Unsecured Personal Loan

Representative 14.7% APR

Hire Purchase (HP)

With hire purchase, you pay off the cost of the car in fixed monthly payments. You won't own the car until the final payment and any additional fees. We offer this through our Dealer Network.

Personal Contract Purchase (PCP)

An option to pay a deposit (normally 10%) and then make fixed monthly payments. You’ll have options to buy or return the car at the end of the contract with a balloon payment. Monthly payments tend to be lower compared to an HP, but there will be a bigger ‘balloon’ payment to pay at the end.

Personal contract hire (PCH)

When you lease a car, you’re paying for the use of the car without ever owning it. It’s a bit like renting and can be a flexible option, especially if you like changing cars frequently. Monthly costs may be lower in comparison to other finance options, but extra charges can apply, for things like additional mileage or 'excessive wear and tear' fees.

Whether you’re after your dream car, thinking about switching to electric, or just need a bit more space in the boot, an Oodle Car Loan could help you cover the cost.

Apply Online

Find out if you're pre-approved in seconds

Complete application

You’ll have your money in your account the next working day

Shop anywhere

Buy the vehicle that suits you best, wherever you find it

Representative 14.7% APR